Tuesday, June 10, 2014

How To Handle Enormous Debt Load Right After Receiving Your College Degree.

More than ever, young adults are being saddled with an enormous amount of debt right after they earn their college degree. They spend the rest of their twenties giving a sizable portion back to the University who just won a bowl game and is hardly hurting for cash. Meanwhile, you're a twenty something lawyer who passed the Bar exam, works for a prestigious firm, yet you eat Ramen and take the bus and duck your landlord at the end of the month. That's no way to enter the workforce--straddled with debt.

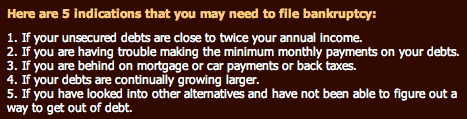

More young adults are filing for bankruptcy than ever. There is a stigma and almost a shame that comes with it, but there needn't be. Think of bankruptcy less a retreat and more a reset. Yes, it will reflect on your credit report and yes it will complicate your financial future at least for the next seven years. "So why would I want that?" You ask...

Here's the alternative. Continue on eking it out. Giving most of your pay to your wealthy college who's degree you might not even be using! Take the bus. Go broke trying to impress clients by paying for your meals only to find your wages have been garnished and your card doesn't work.

You can expect that for much longer than seven years if you don't file for bankruptcy. You don't want to have to play that game where you act like: "it's the banks fault" in front of potential clients. You know good and well there was a fifty-fifty chance your card would work, which is why you only ordered salad and water. You cringed when the potential clients ordered swordfish and champagne. And then came the coup de grâce? Potential client #1 liked the swordfish so much he wants a second to go. For his dog! Your mental cash register just exploded. You know what's coming. Epic embarrassment. You see it on the waiter as his or her demeanor has now changed. They have your card in their hand and a single, short, stubby receipt. We all know what that is. The rejection letter of debit machines. Just like when you got into college. Thin envelope meant: "Sorry! Try again!". Thick envelope meant :"Pack your bags".

Don't get another thin envelope or short receipt. Get your affairs in order. What you handle today will greatly behoove you tomorrow. We will get creditors off your back and allow you to entertain those potential clients without fear of embarrassment.

Monday, June 2, 2014

Can I File For Bankruptcy More Than Once?

Did you know that you can file bankruptcy more than once? Sometimes, we find ourselves in the hole again through circumstances beyond our control. There are options if you should find yourself in need of debt relief.

There are two common types of bankruptcy, Chapter 7 and Chapter 13. You are able to file more than once under each type of bankruptcy, however federal laws set into place in 2005 have made it more difficult. While there is no limit to how often you can refile, filing too closely together can be a waste of time if you would like your debt discharged.

If you initially filed for Chapter 7 bankruptcy (which eliminates most debt) in 2005 you will be eligible to file Chapter 7 again in 2013. Part of the criteria is that you wait at least 8 years between filing. However, if your second filing is for Chapter 13 (which restructures debt), you only have to wait 4 years rather than 8. The time periods between filings are measured from filing date to filing date and not the date your debt was discharged.

Subscribe to:

Posts (Atom)