What Rights Do I Have When Facing Vehicle Repossession?

Getting behind on your credit card payment can be a hassle but when you go into arrears on your car payment, your life can be drastically interrupted. Whenever you enter into a lease/credit agreement with a finance company, they have the right to recover their property, any time of day or night and still invoice you for the balance due on the loan as well as late fees and towing fees. Pretty harsh huh? However, there are strict laws in place that limit what a creditor can and cannot do when seizing your vehicle.

What Can Creditors do

According to state law, and likely the contract you signed while purchasing the vehicle, your creditor can legally seize your vehicle when you default on your loan. The seizure can legally occur immediately. The contract between you and your creditor will usually define "default", but it normally means a failure to make timely payments. One missed payment may be just enough, but typically not. This is because your creditor can agree to accept a late payment or can change the payment date, however this may change the terms of your original contract. These changes can occur by speaking with the creditor, by writing, or by the creditor simply accepting multiple late payments without objection.

When default occurs, state law may permit the creditor to repossess your vehicle at any time of the day - even in the middle of the night while you sleep. Creditors do not need to give proper notice, and may come on to your property to repossess.

What Can't They Do?

Creditors cannot "breach the peace" while confiscating your vehicle. Examples of breaching the peace violations can be using force or threats of force to repossess, seizing your vehicle over protest, or removing it from a closed garage.

If a breach of peace is committed when your vehicle is repossessed, you can be entitled to money damages or your creditor may be required to pay a penalty. Importantly, your creditor may also lose the right to enforce a deficiency judgment against you. A deficiency judgment is the difference between the remaining amount on the loan and the resell amount obtained by the creditor.

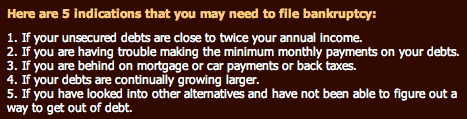

If you or someone you know has had their vehicle repossessed or is facing repossession, call us now. There are limited, but effective actions that can be taken such as bankruptcy, that allow you to keep your vehicle. Remember, time is of the essence. Once they've repossessed your vehicle you have ten days to pay the debt. In some cases the creditor may even refuse the payment and keep your vehicle. Eventually they will sell it and reduce it from the debt you owe them. Don't let it get to this.

For more information regarding your specific situation, contact Minnesota Bankruptcy Attorney Gregory J. Wald at 952-921-5802 or at

BankruptcyMinn.com for a consultation.